Role of Digital Forensics in Financial Crime Investigations: Following the Money Trail

In today’s rapidly digitising economy, financial crimes have evolved far beyond traditional cheque and cash frauds. With the widespread adoption of online payments, mobile banking, and cryptocurrencies, criminals now exploit digital systems to move, conceal, and launder money at an unprecedented scale. Consequently, conventional investigative techniques are no longer sufficient on their own. This is where digital forensics plays an indispensable role, as it enables investigators to uncover digital evidence, reconstruct complex transaction histories, and accurately “follow the money” across interconnected digital platforms.

What Is Digital Forensics?

Digital forensics refers to the systematic process of collecting, preserving, analysing, and presenting digital data in a manner that is legally admissible. Initially developed to investigate computer-related crimes, digital forensics has now expanded into a critical discipline used in law enforcement, regulatory compliance, corporate investigations, and financial crime detection.

Importantly, digital forensics helps investigators establish what happened, how it happened, who was involved, and how illicit funds were transferred or concealed. Therefore, it forms the backbone of modern financial crime investigations.

Key Domains of Digital Forensics in Financial Investigations

Digital forensics encompasses multiple specialised sub-domains. Each contributes uniquely to tracing financial crimes:

-

Computer forensics, which involves extracting evidence from computers and storage devices

-

Mobile device forensics, focused on analysing smartphones and tablets used for transactions and communication

-

Network forensics, which examines network traffic, logs, and access records

-

Database and transaction forensics, essential for tracing financial records and transactional data

Together, these domains allow investigators to correlate digital activities with financial movements.

Financial Crimes in the Digital Era

Today’s financial crimes include a wide range of cyber-enabled activities. These commonly involve:

-

Money laundering and layering to obscure the source of illegal funds

-

Fraud and embezzlement through digital misrepresentation

-

Identity theft and account takeovers

-

Investment scams and digital arrest scams

-

Cryptocurrency-enabled financial crimes

For instance, in India, digital arrest scams have emerged as a major threat. In such cases, fraudsters impersonate law enforcement officials and coerce victims into transferring money. As a result, investigators are often left with a complex trail of digital and financial evidence. In 2025 alone, losses from such scams were estimated to exceed ₹3,000 crore, prompting judicial intervention and the adoption of AI-based tracing methods.

Similarly, large-scale enforcement initiatives such as Operation CyHawk leveraged artificial intelligence to identify suspicious transactions worth hundreds of crores, revealing mule accounts, intermediaries, and crypto conversions used for rapid laundering.

Following the Money: The Digital Forensic Approach

At the core of financial forensic investigations lies the principle of tracking illicit funds from origin to destination. Digital forensics supports this objective through a structured investigative workflow.

Data Acquisition and Preservation

First, investigators seize digital devices, servers, and cloud backups. Subsequently, forensic copies of storage media are created to preserve evidence integrity.

Transaction Reconstruction

Next, bank records, UPI logs, payment gateway data, and blockchain transactions are examined. At this stage, timestamps, IP addresses, device identifiers, and account details are correlated to reconstruct transaction timelines.

Pattern and Link Analysis

Thereafter, investigators identify irregular transaction patterns and link related accounts, wallets, and intermediaries—often spanning multiple jurisdictions.

Maintaining Chain of Custody

Finally, strict documentation ensures that evidence remains untampered and legally admissible throughout judicial proceedings.

Thus, digital forensics allows investigators to rebuild the complete financial narrative behind a crime.

Techniques and Tools Used in Financial Forensics

Modern financial forensic investigations rely heavily on advanced tools and technologies. These include:

-

Data mining and analytics, used to detect anomalies and unusual transaction clusters

-

Machine learning and AI, which help uncover hidden relationships within massive datasets

-

Blockchain analysis tools, essential for tracing cryptocurrency movements

-

Network and log analysis, used to associate transactions with digital identities

-

Visualization and link mapping, which graphically represent relationships among entities, accounts, and devices

As a result, investigators can efficiently identify critical links within complex laundering schemes.

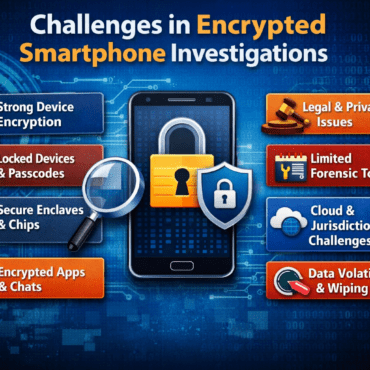

Challenges in Digital Financial Forensics

Despite its effectiveness, digital financial forensics faces several challenges.

Data Volume and Complexity

Modern financial systems generate enormous volumes of data. Therefore, analysing such datasets requires advanced tools and skilled professionals.

Encryption and Privacy Controls

While encryption protects user privacy, it also complicates evidence extraction without proper legal authorisation.

Cross-Border Jurisdiction Issues

Additionally, financial crimes often span multiple countries, making evidence collection legally and procedurally complex.

Rapid Technological Evolution

Moreover, the rise of cryptocurrencies, decentralised finance, VPNs, and anonymisation tools has increased investigative difficulty.

Skill and Resource Gaps

Finally, there remains a global shortage of experts trained in both financial systems and digital forensics.

Real-World Impact and Trends

According to national data, India has witnessed a sharp rise in cyber-enabled financial frauds, resulting in significant monetary losses. Consequently, the government strengthened mechanisms such as the National Cyber Crime Reporting Portal and expanded forensic laboratory infrastructure under the IT Act to support digital evidence analysis.

Best Practices for Investigators and Organisations

To strengthen financial forensic capabilities, organisations should prioritise:

-

Conducting regular forensic audits

-

Integrating AI-driven analytics for early fraud detection

-

Investing in specialised training and certification

-

Promoting public awareness of emerging digital frauds

Conclusion: The Road Ahead

In conclusion, as financial systems become increasingly digital, financial crimes will continue to grow in sophistication. However, digital forensics provides a robust, legally defensible framework for tracing illicit money flows and uncovering critical evidence. By combining advanced analytics, forensic methodologies, and inter-agency collaboration, investigators can effectively follow the money trail—thereby deterring cybercriminals and safeguarding financial integrity in the digital age.

Post comments (0)