Introduction

Examination of stamp paper generally involves identifying the legitimacy and authenticity of the stamp and the document to which it is applied. Contracts, agreements, deeds, and affidavits are examples of these documents.

Stamp paper examination is a critical process that protects the integrity of these papers and assures legal compliance.

A stamp paper examination is a lot more than looking at a piece of paper; it involves looking at the fundamental principles of trust and legality. In the context of law, the intricacies of stamp authentication, the significance of denomination, and the value of ink and paper quality all play crucial roles.

This blog mainly focuses on the stamp papers that are available in India.

What is a stamp paper?

A stamp paper is an A4 (foolscap) piece of paper with a revenue stamp pre-printed on it, similar to the ones found on currency notes or postal stamps. These stamp papers are issued by the government of India and have denominations of ₹ 10, ₹ 20, ₹ 50, ₹ 100, ₹ 500, and so on.

Every stamp paper has a different “Monetary Value.” Any individual who has purchased, sold, or participated in a property transaction must keep a “stamped paper” record of the complete process. Stamp paper can’t be utilized as an instrument of negotiation or for trade or as currency notes. Individuals generally acquire stamps or certain valued stamp papers for specific reasons based on the value of the commercial transaction. The state governments make and sell these stamp papers to the public via registered sellers.

Types of stamp papers

- Judicial stamp paper

- Non-judicial stamp paper

- Non-judicial e-stamp paper

- Franking stamp paper

- Revenue stamp

- Judicial stamp paper: The judge uses judicial stamp paper to give judgments in court. These are the documents that are utilized in the administration of justice. Stamp duty is paid on a judicial stamp paper in compliance with the Court Fees Act of 1870.

Fig. 1: Judicial stamp paper

- Non-judicial stamp paper: Non-judicial stamp paper is a physical stamp that can be used to pay a variety of fees, such as court expenses, registration fees, and similar expenses. It is available through a licensed dealer. Non-judicial stamp sheets can be used for a variety of documents, including commercial contracts, powers of attorney, property transfers, declarations, and so on. A non-judicial stamp is admissible as evidence in a court of law and is regarded as genuine proof of payment.

Fig. 2: Non-Judicial stamp paper

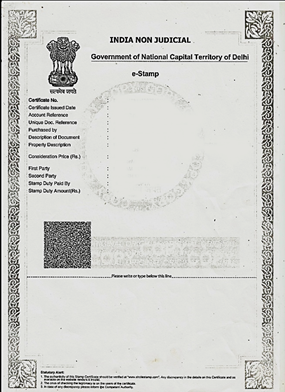

- Non-judicial e-stamp paper: Non-judicial e-stamp paper is an electronic type of stamp paper that can be purchased online from multiple internet platforms. E-stamp paper, which is created using an internet system, has the same applications as non-judicial stamp paper. Physical stamp paper is supposed to be less secure and more susceptible to counterfeiting than e-stamp paper, while e-stamp paper is seen to be more secure than physical stamp paper.

Fig. 3: Non-Judicial e-stamp paper

- Franking– Franking involves a way of lawfully stamping a document by banks or franking centers. The stamping of legal property documents is referred to as franking. Documents can be franked by authorized banks or carters by stamping or adding a denomination. While franking, a franking machine is usually utilized. This machine-made stamp serves as proof that stamp duty has been paid. An alternative method of franking is to purchase pre-franked printed stamp paper.

- Revenue stamp: A revenue stamp is a small piece of paper that is applied to a document to demonstrate that a charge or tax was paid to the government for a specific transaction. Revenue stamps resemble postage stamps in appearance and are used to signify the payment of a levy on objects or papers. They are used to collect fees or revenue for the upkeep of courts.

Fig. 4: Revenue Stamp

The Indian Stamp Act of 1899 is a statute that was revised 51 times between 1899 and 2004. Section 30 allows you to request a stamped receipt with a ₹ 1/- revenue stamp (1-rupee revenue stamp) if you pay more than ₹ 5000 to someone. According to the Indian Stamp Act of 1899, Section 2(23) any receipt over ₹ 5000 (formerly ₹ 500) must have a stamp attached.

Revenue stamp tickets must be important to be submitted with a few documents, such as acknowledging the receipt of any money, cheque, promissory note, or bill of exchange in satisfaction of a debt, or acknowledging the satisfaction or discharge of any debt or demand, or any part of a debt or demand, or which signifies or imports any such acknowledgment; and whether or not it is assigned to the same person.

Revenue stamps, can be purchased at all postal offices and can also be available in local shops.

Revenue stamp receipts includes:

- Acknowledging the receipt of any money, check, promissory note, or bill of exchange.

- Acknowledging the receipt of any other movable property in satisfaction of a debt.

- Acknowledging the satisfaction or discharge of any debt or demand, or any part of a debt or demand.

- Document that signifies or imports any such acknowledgment and whether it is assigned to the same person or not.

Stamp paper authentication

Stamp paper authentication involves analyzing and verifying the authenticity of a stamped paper document to ensure that the document is genuine and legally valid.

The authentication of stamp paper involves the following steps:

- Visual inspection

- Stamp impression

- Serial numbers

- Issuing authority

- Registry check

- Legal expertise

- Document verification

- Legal documentation

- Visual inspection: involves examining the physical characteristics of the stamp paper. Genuine stamp paper generally has certain security features to prevent counterfeiting, such as watermarks, security threads, holograms or foil stamps, paper weight and texture, opacity, color and print quality, supplier information, etc.

- Watermarks: genuine stamp papers have watermarks embedded in the paper.

- Security threads: some stamp paper has security threads running through it.

- Paperweight and texture: high-quality stamp paper is usually thicker and has a smooth and uniform texture.

- Opacity: genuine stamp paper is less translucent.

- Holograms and foil stamps: genuine stamp paper may include holograms or foil stamps. These are difficult to replicate and can be a sign of authenticity.

- Microtext and fine print: inspect the stamp paper for microtext or fine print that might not be visible to the naked eye. Counterfeiters may have difficulty reproducing the details accurately.

- Supplier information: ensure that the stamp paper was obtained from an authorized and reputable supplier or government agency.

- Stamp impression: it involves carefully inspecting the stamp impressions on the paper. It should contain specific details such as the denomination or value of the stamp, the date of issuance, and the name, and logo of the issuing authority which can be a government department or agency responsible for stamp paper distribution.

- Serial numbers: This involves checking the stamped paper for unique serial numbers. These numbers are often printed on the stamp or the paper itself.

- Date of issue: The date on which stamp paper is issued is typically printed or stamped on the stamp paper. This indicates when the stamp paper is issued and is usually recorded to ensure that it is being used for the intended purpose within the legally stipulated time frame.

- Registry check: In some cases, a government registry or database is to be verified to check the authenticity of stamped paper. Certain jurisdictions maintain records of issued stamp papers, which can also be verified.

- Legal expertise: Seeking the assistance of legal experts, notaries, or solicitors who are experienced in stamp paper authentication.

- Legal documentation: ensuring that the stamped paper is used for a legitimate legal purpose, such as agreements, contracts, deeds, and affidavits. Draft the document in accordance with local laws and regulations to avoid legal complications.

- Ink and impression analysis: these can be important when verifying the authenticity of the stamp papers.

- Ink type and color: what type of ink is used for the stamp? Authentic stamps generally use high-quality, non-fading ink. Examining the ink with the standard color used for that particular type of stamp.

- Uniformity: authentic stamps typically have a uniform and consistent ink application. Irregularities in ink density or color could be a sign of forgery.

- Fine details: Analyze the fine details of the stamp, including small text and intricate designs. Counterfeiters may struggle to replicate these accurately.

- Embossing or Raised Seal: Some official stamps are embossed or have a raised seal. Run your finger over the stamp to feel for any raised elements.

- Microprint: Look for micro text or very fine print that might not be visible to the naked eye. Authentic stamps often include these features for added security.

- UV Light: Use a UV (ultraviolet) light source to check for UV-responsive ink or security features that may not be visible under normal lighting conditions.

- Impression Quality: Examine the quality of the stamp impression on the paper. A genuine stamp should leave a clear and sharp impression. Any blurriness or irregularities could be a sign of forgery.

- Security Features: security features are unique to stamp paper, such as holograms, watermarks, or special inks that are difficult to replicate.

- Serial Numbers: Verify the serial numbers on the stamp paper or stamp. Ensure they match any records or databases of legitimate serial numbers.

- Stamp Design: Compare the design of the stamp with known authentic examples. Counterfeit stamps may have design flaws or differences.

- Paper Compatibility: Ensure that the ink used on the stamp is compatible with the type of paper used for the stamp paper. Ink bleeding or smudging may indicate a problem.

Stamp paper denominations and values can vary depending on the country and its regulations. In many countries, stamp paper is used for legal and financial documents to indicate that certain fees or taxes have been paid. The value of stamp paper typically corresponds to the amount of duty or tax required for the specific transaction or document.

- Cancellation marks and seals on stamp paper: these are used to indicate that a stamp has been used and is no longer valid for any other transaction.

Types of cancellation marks used by jurisdiction:

- Punching holes as a method of cancellation.

- Pen cancellation

- Ink stamps often used as cancellation marks by a notary public or government official.

- Seal is applied over the stamp area making it clear that document has been used.

- Additional text, markings or patterns are printed over the stamp area indicating that the stamp has been used.

Transmitted light

It involves shining a bright light through the paper to reveal its details that may not be visible to the naked eye.

It involves watermarks and other hidden features that are used in forensic examination of the stamp paper.

Fig. 5: Indian non-judicial stamp paper under transmitted light

Fig. 6: Indian Non-Judicial e-stamp paper under transmitted light

UV Examination

Fig. 7: Examination of India Non-Judicial stamp paper under UV Light

Examination of stamp paper under UV light involves shining UV light on a stamp paper to reveal its security features, security elements, or fluorescent inks, helping verify its authenticity.

Examination reveals various optical fibers and security threads that glow under UV light, which is a characteristic of genuine stamp paper.

Conclusion

The examination of stamp paper includes determining whether the examined stamp paper is genuine or fake. This conclusion is drawn by considering the various factors of examination that are discussed above, which include various security features (watermarks, security threads, fluorescent inks, etc.), the condition of the paper, signs of alteration, and forgery.

The forensic expert will provide an opinion based on the authenticity of the stamp paper and may also provide evidence to support their opinion, which can be valuable in legal proceedings or document verification such as signatures and handwriting examinations.

REFERENCES:

Post comments (0)