Digital Signature vs Paper Signature: A Forensic and Legal Perspective

In today’s rapidly evolving digital environment, signatures no longer exist only in the form of pen on paper. Instead, digital signatures have become widely accepted for financial, legal, and administrative transactions. However, despite this technological shift, paper (wet) signatures continue to play a crucial role, particularly in forensic investigations and courtroom disputes. Therefore, understanding the difference between digital signatures and paper signatures is essential for forensic professionals, legal practitioners, and students alike.

Understanding Paper (Wet) Signatures

A paper signature, commonly referred to as a wet signature, is created when an individual writes their signature using ink on a physical document. Importantly, such signatures result from coordinated neuromuscular movements that develop over time. As a result, every person’s signature reflects unique writing habits.

From a forensic perspective, paper signatures carry immense evidentiary value. Forensic document examiners analyze these signatures by studying both class and individual characteristics. Moreover, these characteristics arise subconsciously, which makes deliberate replication extremely difficult.

Key Forensic Features in Paper Signatures

-

Line quality and writing fluency

-

Pen pressure and shading patterns

-

Stroke sequence and direction

-

Pen lifts and pauses

-

Letter formation and proportions

-

Natural variation across multiple samples

Consequently, forensic experts can compare questioned signatures with admitted standards to determine authenticity or detect forgery.

What Is a Digital Signature?

In contrast, a digital signature is not a handwritten mark at all. Instead, it is a cryptographic technique that validates the identity of the signer and ensures the integrity of a digital document. Typically, a licensed Certifying Authority issues a digital certificate, which links the signer’s identity to the document.

Furthermore, digital signatures rely on public key infrastructure (PKI) and encryption algorithms. Therefore, any alteration made to the document after signing immediately invalidates the signature.

Key Characteristics of Digital Signatures

-

Uses encryption rather than handwriting

-

Confirms signer identity electronically

-

Detects document tampering instantly

-

Lacks motor or behavioral writing traits

As a result, digital signatures do not allow handwriting-based forensic examination.

Key Differences Between Digital and Paper Signatures

Although both forms serve the same purpose—authentication—their forensic and legal treatment differs significantly.

| Aspect |

Paper Signature |

Digital Signature |

| Nature |

Handwritten and physical |

Electronic and cryptographic |

| Medium |

Ink on paper |

Digital document |

| Forensic Examination |

Possible |

Not applicable |

| Individual Characteristics |

Present |

Absent |

| Risk of Forgery |

Moderate to high |

Very low |

| Verification Method |

Expert comparison |

Certificate validation |

| Legal Framework (India) |

Indian Evidence Act |

IT Act, 2000 |

Thus, while paper signatures rely on expert opinion, digital signatures depend on technical verification.

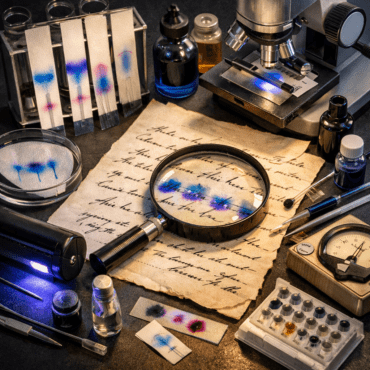

Forensic Examination Perspective

From the standpoint of forensic document examination, paper signatures remain indispensable. Experts actively compare questioned signatures with genuine specimens to evaluate similarities and differences. Additionally, they use tools such as magnification, microscopes, and spectral analysis to observe minute details.

On the other hand, forensic experts cannot examine digital signatures for handwriting characteristics. Instead, investigators verify digital signatures by checking encryption keys, certificate validity, audit logs, and authentication records. Consequently, disputes involving digital signatures often require IT experts rather than handwriting specialists.

Legal Admissibility in India

Legally, India recognizes both forms of signatures; however, the governing laws differ.

-

Paper signatures fall under the Indian Evidence Act, 1872, where courts may rely on expert opinion under Section 45.

-

Digital signatures derive legal validity from the Information Technology Act, 2000, provided a licensed Certifying Authority issues them.

Therefore, while courts accept both, the method of proof varies considerably during litigation.

Security and Vulnerability

Paper signatures face several risks. For instance, individuals may forge, trace, simulate, or disguise signatures. Although skilled forgers can imitate overall appearance, forensic experts often detect inconsistencies in movement and pressure.

In comparison, digital signatures offer stronger protection. They provide encryption, tamper detection, and secure authentication. Nevertheless, digital signatures depend heavily on cybersecurity infrastructure. Consequently, risks such as credential misuse, hacking, or identity theft still exist, although at a lower frequency.

Practical Applications

Generally, organizations prefer digital signatures for online filings, corporate contracts, government portals, and banking transactions because they ensure speed and security. Meanwhile, paper signatures remain essential for wills, property documents, disputed agreements, and forensic investigations where handwriting analysis may become necessary.

Thus, both forms coexist, each serving distinct practical and legal purposes.

Conclusion

In conclusion, digital signatures and paper signatures differ fundamentally in nature, examination, and evidentiary value. Digital signatures excel in efficiency, scalability, and technological security, whereas paper signatures remain critical for forensic examination and handwriting-based disputes. Therefore, professionals must understand both systems to apply them appropriately within legal and investigative frameworks.

As digital transformation continues, the use of digital signatures will undoubtedly expand. Nevertheless, the forensic relevance of paper signatures ensures that handwriting examination will remain an essential discipline within the justice system.

Post comments (0)